This involves deducting the closing work-in-progress from the amount introduced in the process during the current period. Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting.

4: Process Costing (Weighted Average)

Calculating Equivalent Units of Production (EUP) is a crucial process in manufacturing accounting that helps businesses accurately determine the cost of goods sold and the value of their inventory. Equivalent Unit of Production (EUP) is an essential tool in accounting, particularly in the manufacturing industry, as it helps businesses accurately measure their production output and inventory valuation. This article will define the equivalent unit of production, explain how to calculate it, discuss its importance in accounting, explore its advantages and disadvantages, and provide best practices for accurate calculation. The reason why is because the figure of completed units alone is not an accurate measure of a department’s output since some of the department’s efforts during a period are expended on units that are only partially complete.

What are examples of equivalent units of production?

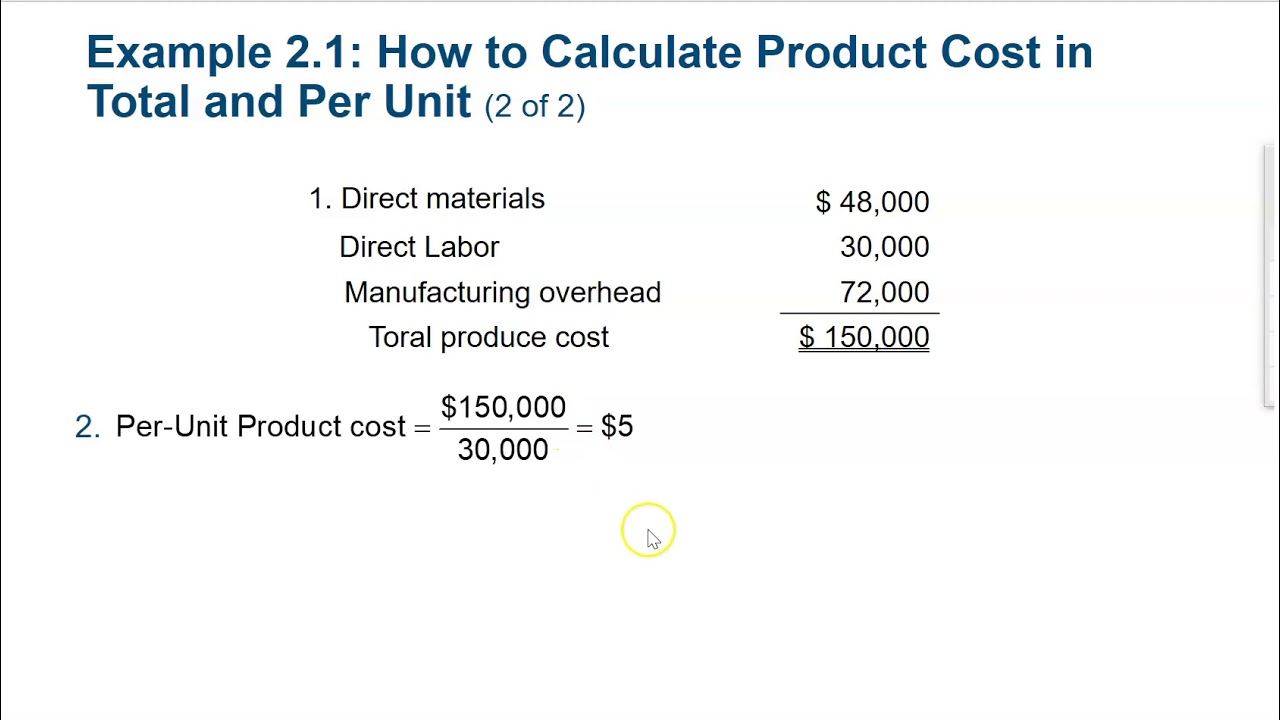

Finally, the equivalent units of production calculated via the previous three steps should be aggregated to ascertain the total output in terms of equivalent units or equivalent production. To calculate cost per equivalent unit by taking the total costs (both beginning work in process and costs added this period) and divide by the total equivalent units. In the current period, we transferred 500 units to process 2, and have 350 equivalent units in our WIP inventory. Essentially saying, that process 1 completed 850 units to completion of process 1 in this period. One thing to keep in mind when using the weighted average method, we don’t need to compute the equivalent units for the ones transferred out.

Looking To Get Started?

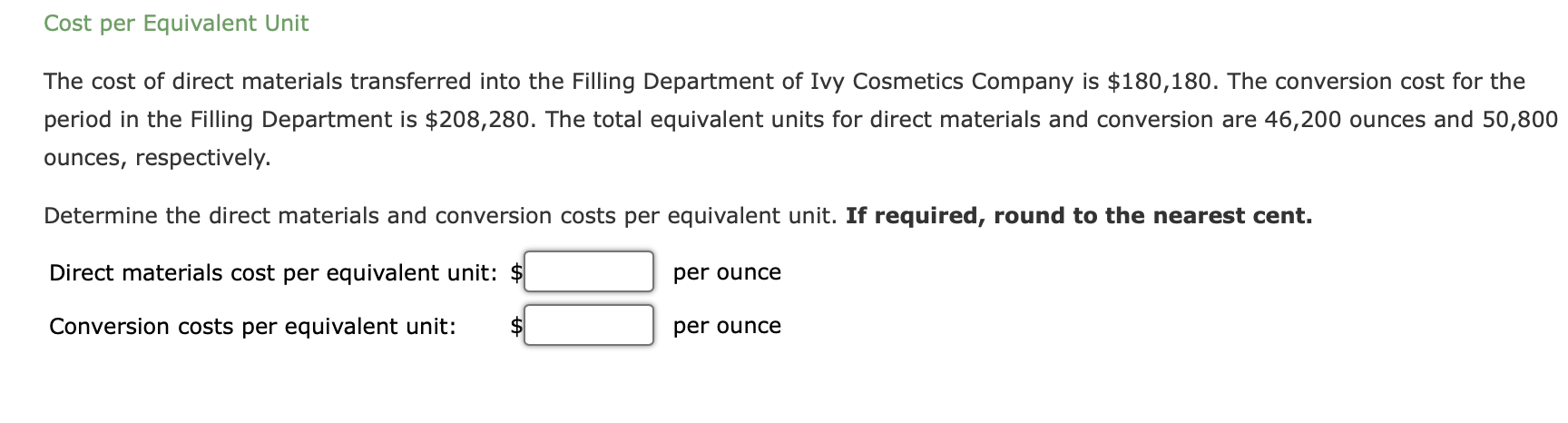

Assume that ending work in process is 25 percent complete for all components of production (material, labor, and overhead). We want to make sure that we have assigned all the costs from beginning work in process and costs incurred or added this period to units completed and transferred and ending work in process inventory. We calculated total equivalent units of 11,000 units for materials and 9,800 for conversion. Companies should allocate joint costs using a consistent method when calculating equivalent production units for joint products.

Do you already work with a financial advisor?

The only direct material added in the packaging department for the 5A sticks is packaging. The packaging materials are added at the beginning of the process, so all the materials have been added before the units are transferred out, but all of the conversion elements have not. As a result, the number of equivalent units for material costs and for conversion costs remaining in ending inventory is different for the testing and sorting department. As you’ve learned, all of the units transferred to the next department must be \(100\%\) complete with regard to that department’s cost, or they would not be transferred. The process cost system must calculate the equivalent units of production for units completed (with respect to materials and conversion) and for ending WIP with respect to materials and conversion. All of the units transferred to the next department must be 100% complete with regard to that department’s cost or they would not be transferred.

- Then ending inventory would be 100% complete asto materials since we received all materials at the beginning ofthe process.

- This is important because the value of work-in-progress inventory is not the same as the value of finished goods inventory, and businesses need to know the true value of their inventory to make informed decisions.

- To calculate cost per equivalent unit by taking the total costs (both beginning work in process and costs added this period) and divide by the total equivalent units.

- EUP calculates the number of completed units that could have been produced from the work in progress during a given period.

Accurate financial reporting is necessary for making informed decisions about business operations, attracting investors, and complying with regulatory requirements. Accurate EUP calculations can help businesses make better decisions about production processes and resource allocation. It helps businesses identify the most efficient way to produce goods, allocate resources, and minimize costs. EUP considers the percentage of completion of each unit and estimates the number of fully completed units that could have been produced from work in progress based on the degree of completion of each unit. Mathematically, this is done by converting the partially completed units into fully completed units and then adjusting the output figure. For example, the closing stock of 200 units in a process, with 60% complete in respect of materials, wages, and overheads, is equivalent to 120 units (i.e., 200 x 60%), which are 100% complete.

The beginning step in computingDepartment B’s equivalent units for Jax Company is determining thestage of completion of the 2,000 unfinished units (rememberunits completed and transferred are always 100% complete). InDepartment B, the ending units may be in different stages ofcompletion regarding the materials, labor, and overhead costs.Assume that Department B adds all materials at the beginning of theproduction process. Then ending inventory would be 100% complete asto materials since we received all materials at the beginning ofthe process.

So the number of units transferred is the same for material units and for conversion units. The process cost system must calculate the equivalent units of production for units completed (with respect to materials and conversion) and for ending work in process with respect to materials and conversion. All of the units transferred to the next department must be \(100\%\) complete with regard to that department’s cost or they would not be transferred.

The total of the cost per unit for material (\(\$1.17\)) and for conversion costs (\(\$2.80\)) is the total cost of each unit transferred to the finishing department (\(\$3.97\)). For the packaging department, the materials are \(100\%\) complete with regard to materials costs and \(40\%\) complete with regard to conversion costs. The \(6,500\) units completed and transferred out to the finishing department must be \(100\%\) complete with regard to materials and conversion, so they make up \(6,500 (6,500 × 100\%)\) units.

EUP helps businesses determine the value of their inventory at different stages of production accurately. This is important because the value of work-in-progress inventory is not the same as the value of finished goods inventory, and businesses need to know the true value of their inventory to make informed decisions. Therefore, to convert the work-in-process inventory into equivalent units, it is important to keep the percentage of completion in the calculation. To solve deciding when to file taxes this year depends on income changes the problem of work-in-progress, we can calculate equivalent units of production (or “effective production”). What this example shows is that although there are 200 physical units of product in work in process, as they are only 25% complete it is equivalent to having 50 units of finished, fully completed product. Essentially, the concept ofequivalentunits involves expressing a given number ofpartially completed units as a smaller number of fully completedunits.

All of the costs incurred during the period would be allocated to the goods because they were all completed. Now you can determine the cost of the units transferred out and the cost of the units still in process in the finishing department. Understanding equivalent production units is essential for businesses to accurately determine production costs and track inventory. It enables businesses to estimate the total number of completed units that could be produced from the work in progress. We will calculate a cost per equivalent unit for each cost element (direct materials and conversion costs (or direct labor and overhead).