The min/max inventory system primarily operates around the concept of setting a minimum and a maximum inventory level. Optimize reorder points (ROP) by accurately calculating your company’s demand during lead time and your supplier’s lead time (in days). If there’s a difference in lead times among various suppliers, create individual ROP calculations for each of those suppliers.

Get the Excel Files

The calculator only accepts the mathematical function to deliver the solution. In its original form, Min/Max ordering was considered to be a fairly static method of inventory control where the Min/Max values were rarely changed, maybe a few times per year. The ABC Analysis was frequently used to guide practitioners to spend more the irs says you have until july 15 to make 2019 ira or hsa contributions time revising the “A” items which traditionally require more attention than “B” or “C” items. Having a robust min/max inventory system in place is crucial for businesses of all sizes. Not only does it help in preventing stockouts and overstock situations, but it also enhances operational efficiency and customer satisfaction.

What are the benefits of inventory forecasting?

This number will be different for every business, but is typically between 95-98%. For example, this formula (for Excel 365) finds the minimum quantity for the customer selected in cell C3, and the product name in cell B6. In Excel 2019, or Excel for Office 365, you can use the MINIFS and MAXIFS functions, shown below, to find a minimum value, or maximum value, based on one or more criteria. Calculate the values of the function at all these points and ends of the interval. The point at which the largest value is obtained is the global maximum and the lowest value is the global minimum. The Min/Max method was one of the earliest automated inventory replenishment methods to be used in enterprise software dedicated to inventory management.

Benefits of a min-max inventory strategy

There’s a spill formula in cell B6 to create a unique list of products. The MAXIFS formula refers to that cell with the spill operator — B6# — so the MAXIFS results spill down too. The MAXIFS formula has a spill operator (#) at the end of that cell reference — B4# — so the MAXIFS results spill down too. The MINIFS formula refers to that cell with the spill operator — B6# — so the MINIFS results spill down too.

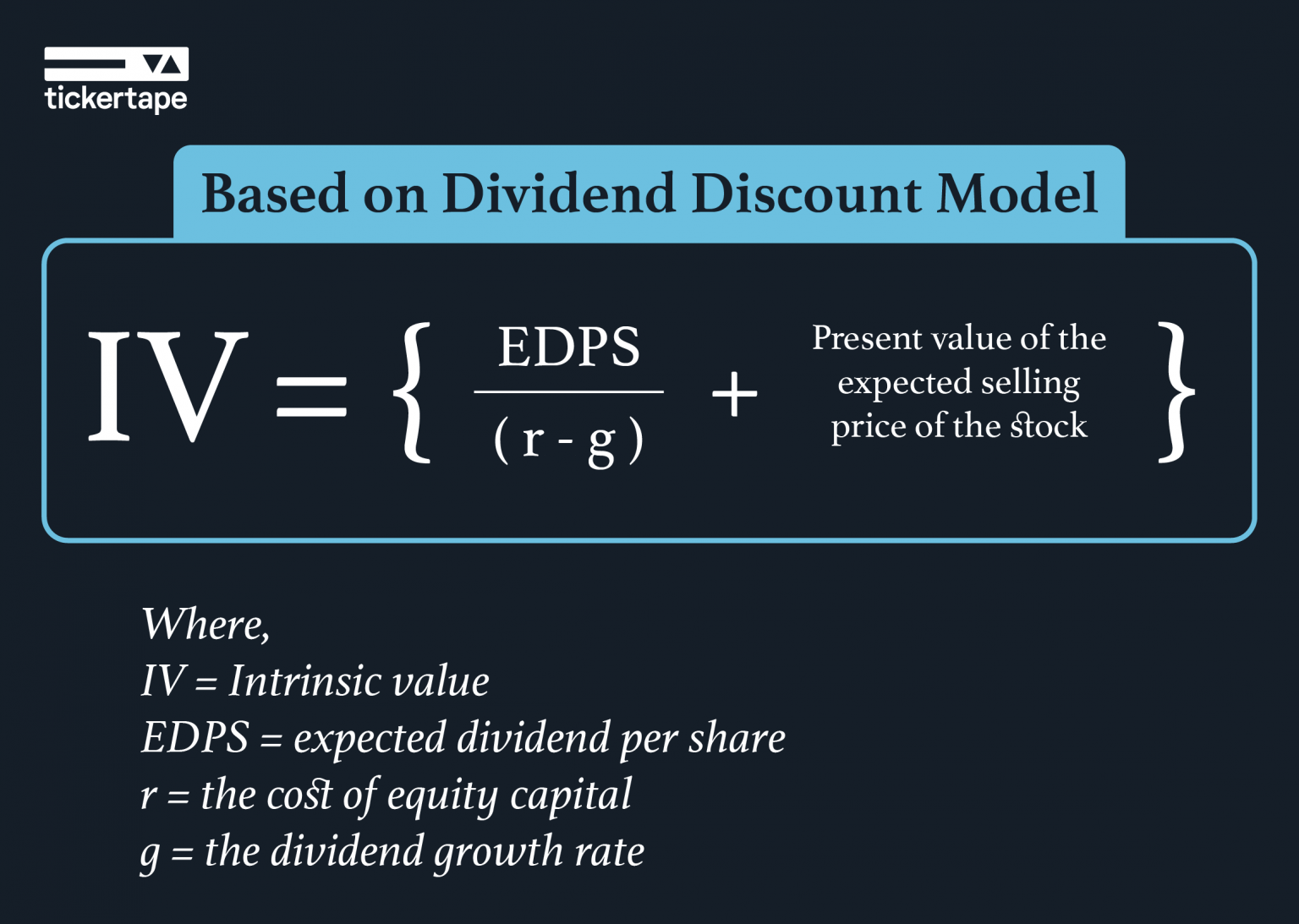

Min/Max Inventory Formula:

- Regularly review and adjust your min/max levels based on real-time data to ensure the highest level of efficiency and profitability.

- Businesses usually set the reorder point at or just above the minimum inventory level to prevent stockouts and keep revenue flowing.

- This can be calculated by taking your current sales and dividing it by the number of days in your calculation period.

- If an argument is a reference or array, any empty cells, logical values, or text are ignored, when calculating the maximum value.

By accurately determining the minimum and maximum levels of inventory required, businesses can establish more precise reorder points. To set up your min/max inventory system, ensure that you have reliable inventory management software or tools that enable accurate tracking of stock levels. After running with these new min/maxes for a month or two, the user can use TrackStock’s Min/Max Tuning Dashboard to recalculate what the min/maxes should be based on the most recent usage. The user can then use the slider again to move the current min/maxes closer to the optimized min/maxes, then set all the levels from the Dashboard again. Either action will change the average daily usage since another day without a Pull will reduce the average. This responsive system allows for heightened accuracy and more efficiency.

By understanding and calculating these levels effectively, businesses can optimize their stock levels and improve overall operational efficiency. By setting accurate min/max levels, businesses gain better control over their inventory. Optimal stock levels prevent stockouts, minimize carrying costs, and maximize order fulfillment rates, leading to improved customer satisfaction and organizational efficiency. Some industries may require higher stock levels due to longer lead times or specific customer demands. Balancing inventory turnover with customer satisfaction is key to optimizing your inventory management.

This is the amount of inventory you reorder when stock reaches the reorder point. In Excel 2019, or Excel for Office 365, you can use this MAXIFS formula, to find the latest price. Use the MINIFS function to find the lowest number, based on one or more criteria.

If an argument is a reference or array, any empty cells, logical values, or text are ignored, when calculating the maximum value. If an argument is a reference or array, any empty cells, logical values (true or false), or text values are ignored, when calculating the minimum value. “TrackStock allows the user to reset all of the min/maxes from the Min/Max AI Dashboard rather than entering each one manually.” However, you can avoid this hassle with the help of the Maximum and Minimum Calculator. It swiftly determines the target function’s global extremum and provides a graphical illustration of the function for easier comprehension.