Cost traceability is the ability to identify and track the costs of a product, service, or activity from their sources to their destinations. It is a crucial aspect of cost management, as it helps to allocate costs accurately, evaluate performance, and identify opportunities for improvement. Cost traceability can be applied to different levels of analysis, such as individual transactions, processes, departments, or organizations.

What is an example of a indirect cost in manufacturing?

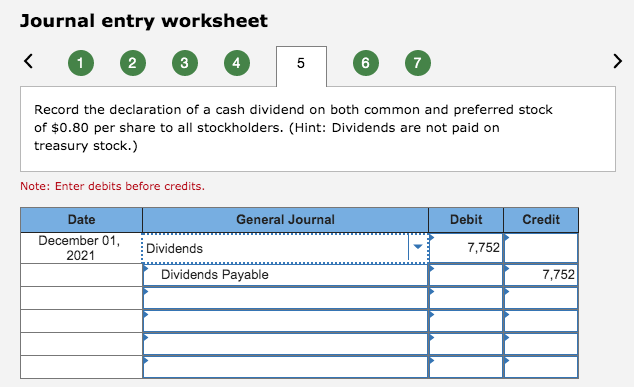

Traceable costs exist only as a result of the existence of a particular segment within a business. Assigning common fixed costs to segments impacts the ability to improve profitability in the long run. Every cost for a firm must be assigned to a cost objective, which may be a production department, a division of the firm, or a unit of production. The key difference underpinning these two terms—direct and indirect costs—is their traceability.

Common Fixed Costs

Cost attribution is the process of linking costs to cost drivers based on some causal or logical relationship. You need to choose the most appropriate and accurate methods for allocating and attributing costs to your cost objects and cost drivers. There are different methods available, such as direct, indirect, activity-based, or value-based.

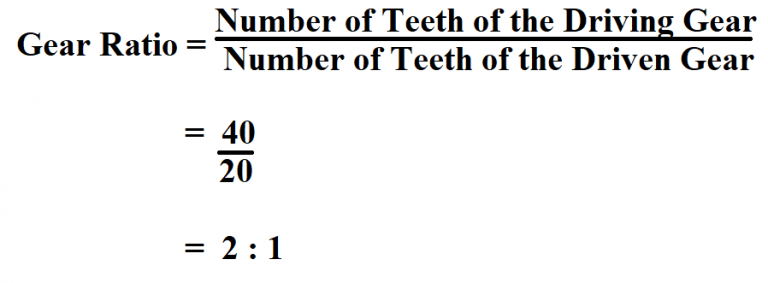

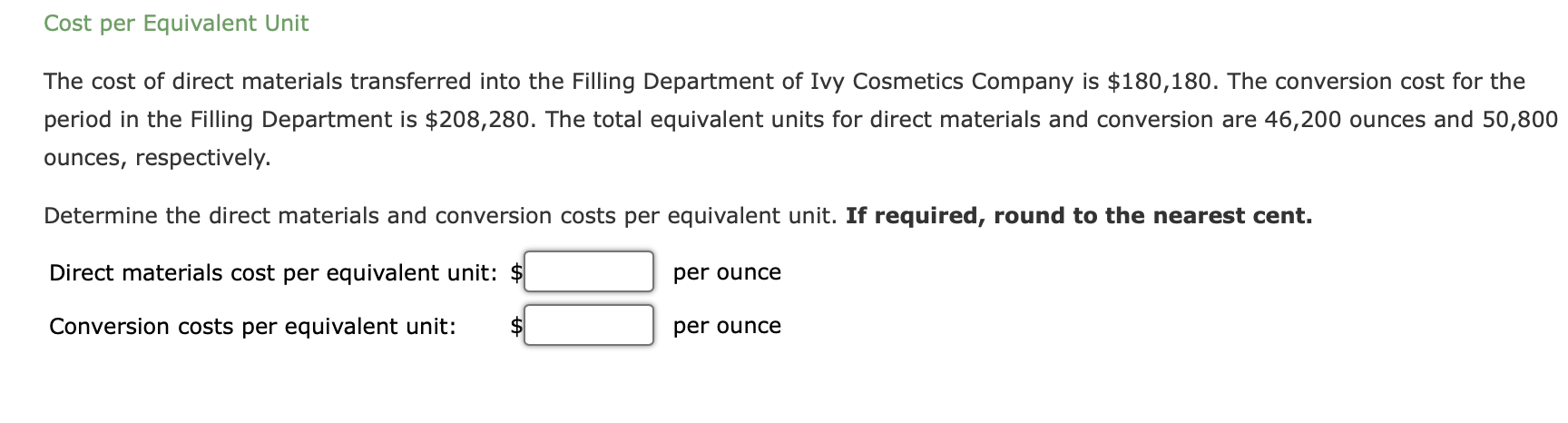

- Calculating the cost driver rate is done by dividing the $50,000 a year electric bill by the 2,500 hours, yielding a cost driver rate of $20.

- Some fixed costs that are considered traceable by one segment may be considered common costs by another segment.

- However, small businesses face scarcities in resources due to different limitations—such as financial capabilities, difficulty in accessing materials, and other external factors.

- This kind of cost should be separated into the income statement which helps management to make a decision.

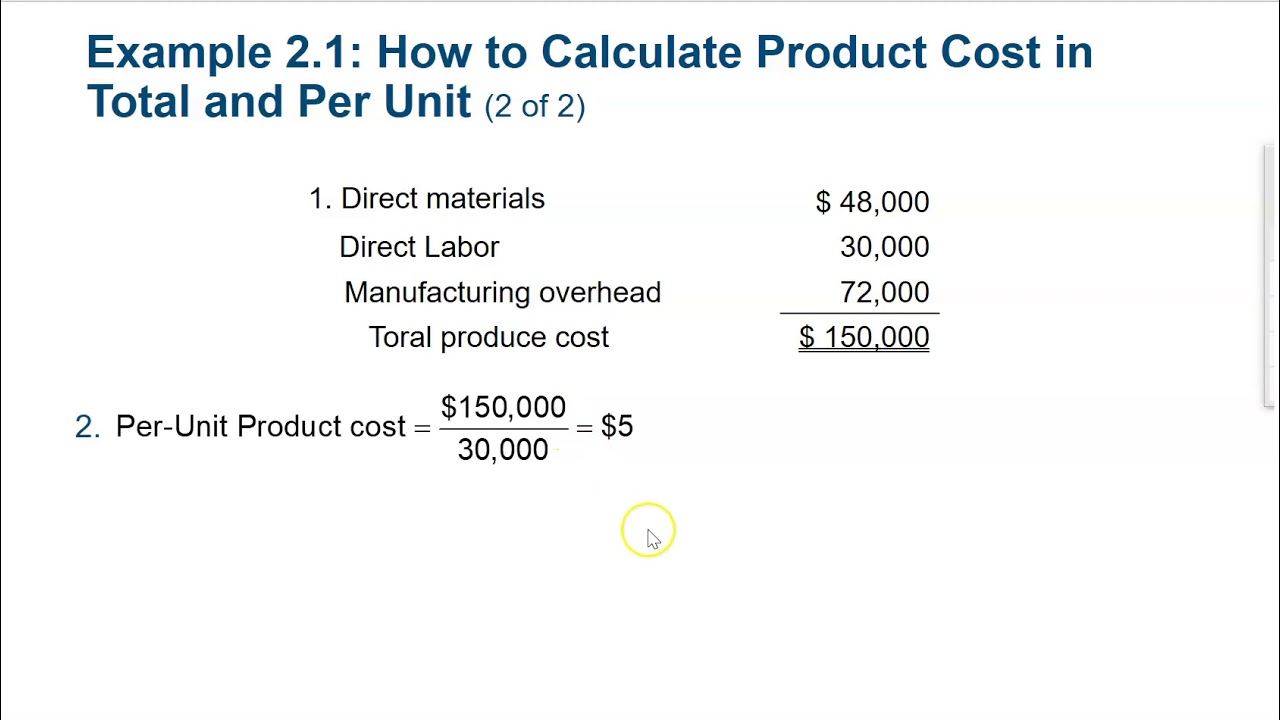

Products

Determining direct costs to a product also helps you in allocating resources. However, small businesses face scarcities in resources due to different limitations—such as financial capabilities, difficulty in accessing materials, and other external factors. With $35 as the goal, you can do a deep dive in product development and understand how the business can achieve this target cost. This strategy is not only about minimizing or reducing costs but also enhancing product quality and adding more value for customers.

Cost pools are the groups of costs that share a common cost driver, such as the overhead costs of a department or a factory. Cost objects are the products or services that consume the costs, such as a unit of output, a customer order, or a project. By analyzing the cost drivers, the cost pools, and the cost objects, managers can determine the cost behavior, the cost structure, and the cost allocation of the business process or the product. This can help them to optimize the resource utilization, reduce the waste and inefficiency, and enhance the value proposition. This can help the manager to decide which products to produce more or less, which products to increase or decrease the price, and which products to improve or discontinue. Cost traceability analysis is a crucial aspect of decision-making and performance enhancement in various industries.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

Once you have defined your objectives, scope, cost drivers, cost objects, and cost allocation and attribution methods, you need to implement your cost traceability system. This involves collecting, processing, storing, and analyzing the cost data from various sources and systems. You need to ensure that your cost traceability system is reliable, consistent, and scalable. You also need to traceable cost ensure that your cost traceability system is integrated and compatible with your existing systems and processes, such as accounting, budgeting, forecasting, reporting, and decision making. Contrastingly, common costs, also known as indirect costs or allocated costs, can’t be traced directly to a single cost object.

In the past, we believe that the fixed costs remain the same regardless of the business operation. However, now we can separate the fixed cost by different cost objects such as segment, location, and so on. The division manager or department manager will typically not have control over indirect costs. Indirect costs are costs that cannot be conveniently and economically identified with cost objectives and must be allocated—on some equitable basis—to the cost objectives or segments under consideration. First, it expands the number of cost pools that can be used to assemble overhead costs. Instead of accumulating all costs in one company-wide pool, it pools costs by activity.