He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. If you’re interested in learning about common stock, you may also in learning about the best broker available for your needs, so visit our broker center to discover the possibilities. In recent years, more companies have been increasingly inclined to participate in share buyback programs, rather than issuing dividends.

What is Safety Stock?

Price is the company’s stock price and book refers to the company’s book value per share. A company’s book value is equal to its assets minus its liabilities (asset and liability numbers are found on companies’ balance sheets). A company’s book value per share is simply equal to the company’s book value divided by the number of outstanding shares. Investing in common stock means you’re putting your money into a part of the company’s journey. Understanding how dividends, voting rights, and the value shown in financial reports affect your investment as a stockholder can help you make smarter choices.

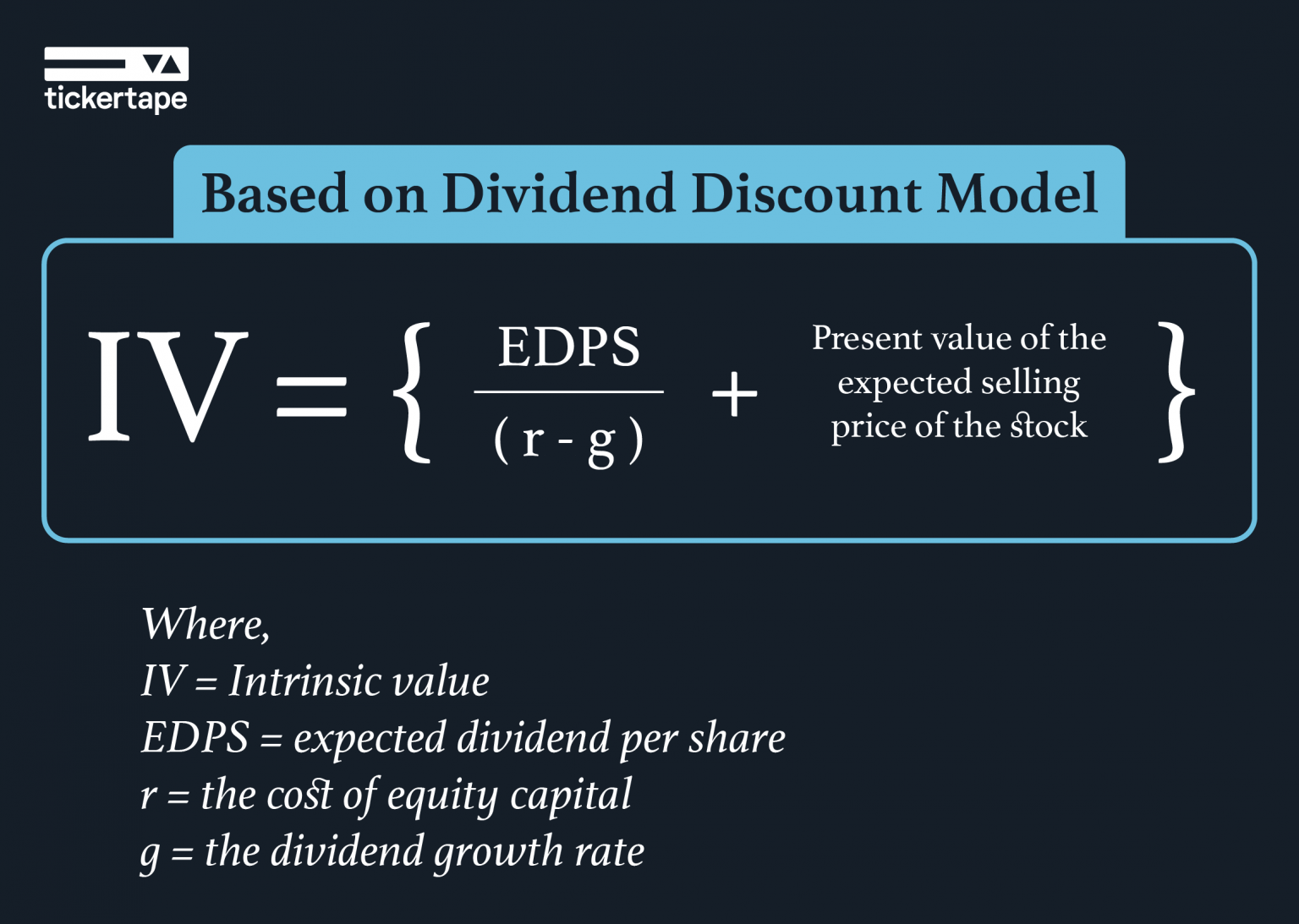

Authorized shares

Market demand may increase the stock price, which results in a large divergence between the market and book values per share. In the event that the company issues stock at a premium, the following journal entry is recorded in the general ledger. As an illustration, XYZ Co. issues 10,000 shares at a $1 PAR value and a $0.5 premium. Risk premium can be thought of as the percentage that would need to be added to a risk-free return on investment to entice an investor into investing in the risky investment being offered.

How comfortable are you with investing?

The common stock outstanding of a company is simply all of the shares that investors and company insiders own. This figure is important because it translates a company’s overall performance into per-share metrics, making an analysis much easier regarding a stock’s market price at a given time. If there are 100 shares outstanding and you buy one, you own 1% of the company’s equity. In the equity section of a balance sheet, common stock shows the amount of money that holders of common stock have invested in the company. It includes the basic investment (par value) plus any extra (additional paid-in capital). This section helps everyone see how much of the company’s value comes from its owners’ investments.

- Common stock is listed under the Stockholders Equity section in a company’s balance sheet.

- If not detailed there, notes accompanying the financial statements may hold further insights.

- Now before knowing further about common stocks, have a look at a balance sheet.

- The company provides the conversion rate in a footnote or a parenthetical note following the description of preferred stock.

How to Calculate Cumulative Dividends Per Share

The dividend payout ratio shows how much of a company’s earnings are distributed to shareholders in the form of dividends. It reflects the balance between rewarding meet the xerocon brisbane team shareholders and reinvesting profits into the business for future growth. When people think about investing in a company, common stock is a big deal.

Pros and Cons of Preferred Stock

This is where investors can calculate the book value, or net worth, of their shares, which is equal to the assets minus the liabilities of the company. Therefore it is essential that financial managers get this recording process right. Preferred stock is another form of stock issued by companies or entrepreneurs sourcing capital from markets. Unlike common stock, preferred stock is not accompanied by voting rights and fixed dividends. Suppose a company issues 100 shares in the public markets representing 75 percent of the company’s total equity. Then each individual common stock is equal to a 0.75% stake in the company.

A company with a defensible economic moat is better able to compete with new market participants, while companies with large user bases benefit from network effects. Four figures can produce some great returns if invested in the right places. With Taxfyle, your firm can access licensed CPAs and EAs who can prepare and review tax returns for your clients. Set your business up for success with our free small business tax calculator. Save more by mixing and matching the bookkeeping, tax, and consultation services you need.

The financial report of a company gives you the scoop on how it’s doing, including the value of the stock per share. It shows how much money was raised from selling shares to investors, often referred to as the common stock balance. This money is used to grow the company, pay for things it needs, or even pay off debts, ultimately benefiting common stockholders. Looking at the number of outstanding shares, the total number of shares authorized to issue, and the book value can tell you a lot about a company’s assets, liabilities, and overall financial health.